A post-COVID-19 strategy means getting back to basics with the 4Ps: product, price, place and promotion.

To say that COVID-19 has altered consumer behavior would be an understatement. To what extent our habits have changed and for how long, however, remains uncertain. That leaves marketers on shaky ground when it comes to strategic planning. A global shift from response to recovery to resiliency is already underway. Some brands will thrive during this transition; others will struggle.

Focus on what you can control

Spending on groceries, household supplies and home entertainment continues to be strong as long as stay-at-home orders remain largely in place. Consumers have pulled back in categories such as apparel, personal services, consumer electronics, travel and outside entertainment thanks to home isolation and loss of income. But how long will these trends continue?

Extrapolating lessons after a disruption of this magnitude is risky. In the midst of uncertainty, focus on what you can control. That means getting back to basics with the 4Ps: product, price, place and promotion.

Learn what disrupted decision making looks like

Solid behavioral insights are the strongest foundation upon which to build your new marketing mix. Brands should be working to understand how the extreme change of context brought on by COVID-19 has triggered a disruption in consumers’ buying behaviors.

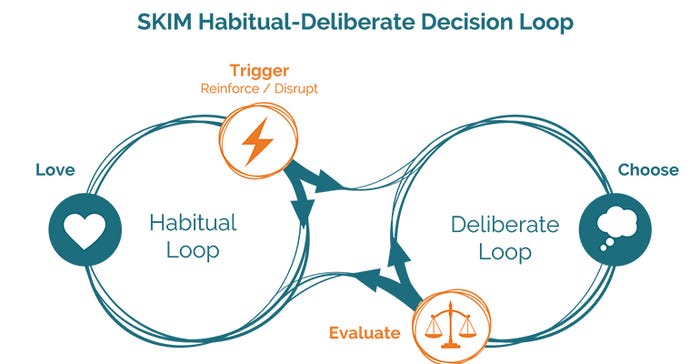

Even in the midst of profound behavioral shifts (whether sudden or gradual), the fundamentals of consumer decision making remain true. SKIM’s Habitual-Deliberate Decision Loop model provides a framework for understanding disrupted decision behavior.

In fast-moving consumer goods segments, consumers spend most of their time on the habitual side of the loop. Shoppers stick to their routines when it comes to purchasing frequency, where to shop and how much they’re willing to pay.

Any change of context can push them out of their routine. Be it a discount, a new product, a new claim, etc. They will reconsider their behavior — consciously or unconsciously. The current crisis is a major change of context, and the usual cues that trigger many decisions have vanished. This presents opportunities for brands. Each of the 4Ps can help lead consumers to your products, since they are more open to options right now.

Adapt your 4Ps to a disrupted reality

When you understand your consumers’ decision loop, you can more confidently adapt your 4Ps to a newly disrupted context. Here are some considerations given what we know today about disruptions to the food and beverage industry:

Product:

Many companies have paused ongoing innovation plans to focus on “in-the-moment” projects aimed at alleviating immediate consumer needs. As we prepare for a recovery period — and subsequent recession — it’s important to consider possible innovation opportunities in response to behavioral shifts.

As you reassess your innovation strategies and perhaps re-prioritize your product pipeline, consider these elements:

Did the disruption permanently change the context of what people feel they need? E.g. Increasing health awareness was already driving behavior pre-COVID; will this trend receive a boost?

Which features and benefits are more/less valuable as consumers make deliberate decisions during and following the crisis?

Place (Omnichannel):

The surge in online shopping and social media consumption has accelerated. However, for certain categories, countries and consumer demographics, the change in context is creating a “forced trial” of new online shopping behavior.

For example, prior to the crisis, consumers tended to buy bigger packs online and were more open to bundles. Are today’s new online shoppers following the same tack? As online shopping becomes more prevalent, is your online portfolio up for the test?

After the SARS epidemic, we saw a quick recurrence of eating at restaurants. As today’s stay-at-home orders begin to lift, will people continue eating at home?

Price:

New contexts and habits will no doubt impact portfolio pricing. Long-held assumptions may be out the window. Start by segmenting (new and loyal) consumers, then look at how they buy now, how conditions have changed for them, and what alternatives they’re exploring.

Follow your customers’ disrupted decision loop to find the answers. This might mean reinforcing and rewarding buying habits for current consumers, while offering a promotion to trigger a deliberate choice of brand or SKU to attract new consumers. Now more than ever, a data-informed pricing strategy will be critical to meeting your net revenue goals.

How long will the trend toward fewer shopping trips and larger package sizes remain? A recession will increase price awareness and price sensitivity, but how much, and which products will be particularly affected?

Promotion:

What messaging will deliver the most impactful content to boost awareness, engagement and conversion— both online and in-store?

Depending on where consumers are in their decision loop, advertising may aim to reinforce brand loyalty, such as by boosting engagement on social media. Or it may need to trigger an action, such as repeat or trial purchases across channels.

Consider the three most important consumer needs at the moment: protection, connection and entertainment. Consumers are adjusting their beliefs and behaviors daily. What are your consumers doing differently than before? In what situations? For what needs? For which purposes?

While some sectors are being hit harder than others, disruption always presents an opportunity to adapt and respond to new market opportunities. The game is on.

Arne Maas is a commercial team leader at SKIM, a leading insights agency specializing in decision behavior. Arne works with clients to solve communications, eCommerce and revenue management challenges across the consumer goods, technology, and consumer health industries.

About the Author(s)

You May Also Like